Tips for NRIs to Apply PAN Card in India Online

An NRI can apply for PAN card in India online. Let’s go through every intended question, which the non-residents often think about in its context.

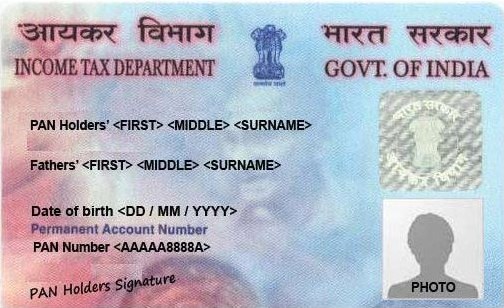

PAN Card

The PAN is an acronym of Permanent Account Number. This number acts as a code to determine transactions made by individuals, families and corporate (Indian and foreign). This 10-character alphanumeric identifier is essential to be issued to all judicial entities registered under the Indian Income Tax Act, 1961.

Is PAN card mandatory for NRIs? Or, why do NRIs require this card?

Yes, the non-residents of India (NRIs) must have this card, if:

- They receive taxable income in India.

- They want to share trading by a depository or a broker.

- They intend to invest in mutual funds.

- They are willing to purchase a piece of land or a property.

The government of India doesn’t approve any of the aforementioned requests by the NRIs, if they don’t have this card. They all represent financial transactions, which can be probed by the legal entities in India.

Therefore, the diaspora with Indian passport should apply for this card. Its process is fairly simple.

How NRI Can Apply for Pan Card in India Online?

PAN card application form online: The non-residents are segmented into two entities-one with foreign citizenship and other with retained citizenship of India. Thereby, the applicant should determine his category before applying for this card online.

Subsequently, one can fill an online application form for getting PAN card. These online forms are, again, available specifically according to the aforesaid categories. Therefore, the non-resident should opt for these forms accordingly on the websites of UTIITSL and NSDL:

- Form 49A: This online application form is meant for Indian citizens.

- Form 49AA: It’s for those who have surrendered their citizenship, but still want to transact with or invest in India.

Fee Structure:

- If the applicant mentions the Indian postal address for communication, he would pay INR 107.

- If the applicant’s communication address is outside India, he would pay INR 989, which includes additional charges for dispatching it.

Modes of Payment: The applicant can pay through any of these payment modes:

- Debit/ Credit Card

- Netbanking

- Demand Draft, in favour of UTIITSL /NSDL

Documents for NRI’s PAN Card Application:

Besides payment, the applicant should post the supporting documents, either online or through courier services. Help yourself with the list of documents that should be enclosed with the online PAN card application:

- Duly attested two photographs pasted in the acknowledgement form

- Duly attested copy of passport as a proof of identity

- Duly attested address proof, like a copy of passport or, copy of bank statement in the country of residence or, a copy of the NRE bank account statement showcasing two transactions during previous six months.

Process of applying for this card online:

- Access the official websites UTIITSL/ NSDL.

- Select and fill the application form.

- Save when the blanks are completely filled.

- Take its print out.

- Paste your photographs and attest them as per guidelines.

- Scan and upload it again.

- Send it to the registered office.

- As you submit the form, an acknowledgement slip will pop up. It contains a 15-digit acknowledgement number. You can use it to check the status of your application.

- The application should reach the designated address within stipulated period of 15 days.

- Once you make the payment & it is realized, the competent authority will dispatch the card finally.

- The card will be delivered to the communication address, as the applicant has mentioned.

The applicant should be aware of the fact that it dispatches the card only in selected countries. You can check the list mentioned on the official website.

this is link

this is link