Certificate of Identity Issued by Gazetted Officer/Tehsildar

Certificate of Identity:

Identity is what defines the existence of a person. When someone calls you by the name, it signifies your identity. But, the government believes in proofs of who you are. It can’t keep in mind the name of all civilians altogether. Therefore, it maintains a record of every individual living in a particular region. Thereby, whenever it comes to seeking public services, the government officers ask for the certificate of identity. It’s mandatory to prove your identity.

In the nutshell, the certificate of identity issued by the gazette officer on the letter head is the proof of your identity. If you don’t have any documented proof of your identity, which generally is issued by the government of India, you can approach the gazette officer. He or she puts his/her stamp and signature to certify that your identity is authentic.

Certificate of Identity by a Gazette officer/ Tehsildar:

The Indian government issues Aadhaar Card as the certificate of identity. It’s a 12-digit random number that provides a genuine identity to the citizens. Even, NRIs get it before immigrating to the foreign country. Anybody can apply for the Aadhaar Card from its authorized centers. But, there are several rural areas where this facility is yet to provide with. In those regions, the certificate of identity having photo issued by a Gazetted officer/Tehsildar on the letterhead are recognized. This document can be used to seek Aadhaar Card or passport or address proof. Even, you can open a bank account by showing it.

Class 1 Gazetted Officer:

The foremost thing is to know who the class 1 gazetted officers are. This list will help you to determine those officers easily:

- Officers Of Armed Forces

- Central & State Governments Employees With Group A Service Rules (IAS, IES, IFS, SDPO, DIB, CP, DGP,

- JCP, IGP, ADLCP, DIG, DCP, SSP, DCP, SP, ASP, ACP, DSP, COLONEL etc.

- Scientists (In Govt. Funded Research Org),

- Vice-Chancellor To Assistant Registrars, Principals & Faculty Members Of Central & State Universities,

- Doctors, Engineers & Drug Controller (Central & State Services),

- Magistrate & Above In Judicial Services

- Additional District Civil surgeons

- Commissioned officer of Armed Forces & Central Armed Police Forces.

- Assistant Professor of Government colleges/University Lecturer of Polytechnic college

Benefits of the Identity Proof:

You can contact any of these class-1 officers in the Indian service. Thereby, you will be able to get a verified document that is approved for claiming these benefits:

- The government recognizes who are marginalized and underprivileged people. This recognition helps it to avail multiple government schemes for their welfare and uplifting.

- This proof will slash the cost of transactions, which are for the benefits of the civilians.

- This document enables its holders to claim the leverages that are granted under the umbrella of the Indian government, its schemes and services, like NPS.

- It ensures direct benefit transfer, like LPG subsidy.

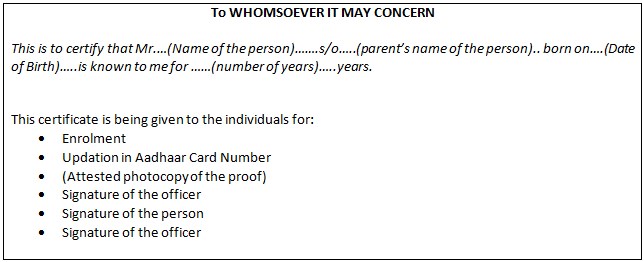

What is the format of certificate of identity having photo issued by gazette officer?

The certificate of the identity having a photograph issued by the gazette officer format for Aadhaar Card reflects more or less similar to the given one. It may or may not vary from this one (imitated from the public forum):

this is link

this is link