Indian diaspora is scattered across the globe in big count. Alone, Germany houses 35000 NRIs. In Switzerland, this count is estimated around 13,500. And this figure jumps upto 2,226,585 in the US while in UK, it’s 1,051,800. A mammoth part of Indian population lives abroad. Many of them are still connected to their roots here. Property investment, their capital investment in shares, NPS and other finance schemes paint the apparent picture of their firm connectivity.

How much income of NRIs is taxable?

Like other tax payers, Indian community members abroad are considered as taxmen. Their income sourced from indigenous ground is termed as taxable income. But a certain criterion is fixed by the finance department of the country. As per it, their domestic income, including rental income, exceeding INR 2, 00,000 is taxable. NRI legal services provide thorough acknowledgement of taxes and their exemptions. For example, many of them are unaware of the fact that they qualify for tax payment on short or long term capital gain. But it should be earned after selling any equity or share or property.

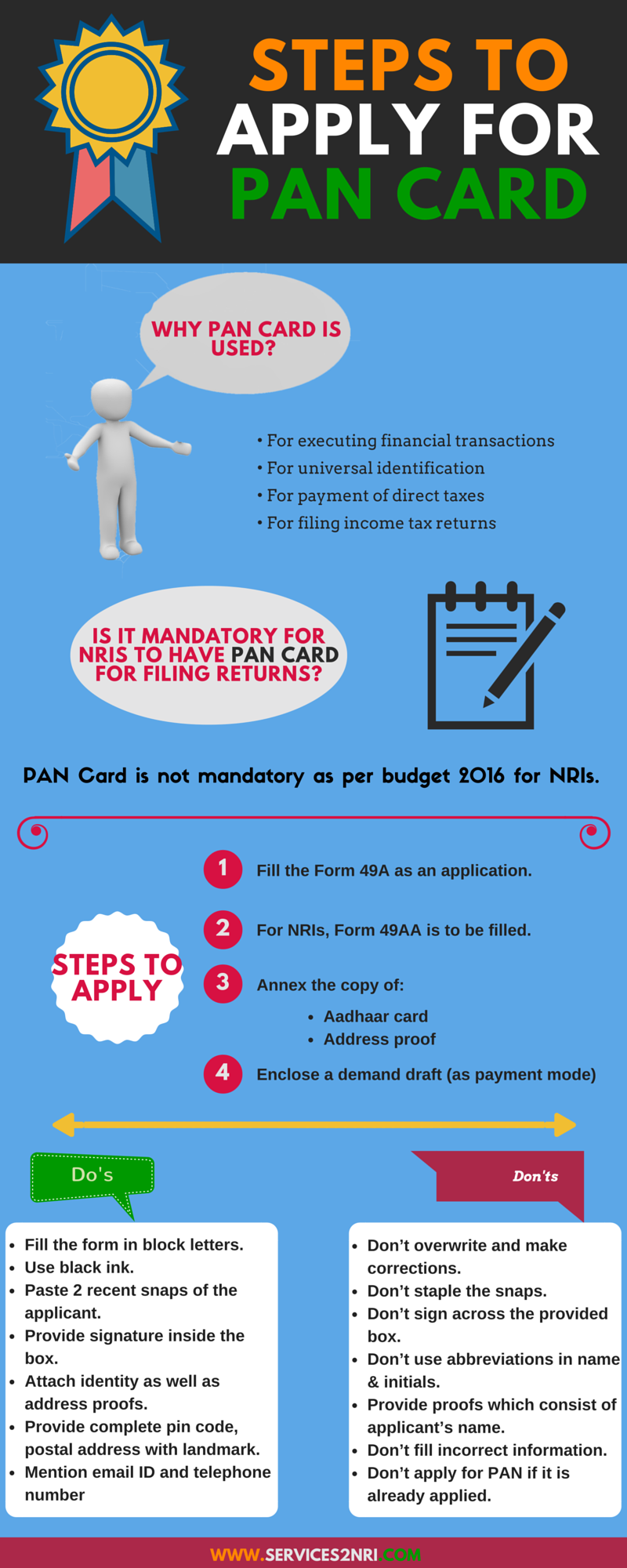

Good news for NRIs who have no PAN card

The drafting of Section 206AA of Income Tax Act declares it mandatory to have PAN card for enjoying leniency in tax rate. In budget 2016, finance minister has announced that non-residents of India had to pay the higher rate of TDS if they did not have the foretold card.

A PAN card (PAN) renders permanent account number of ten-digit alphanumeric number. Income tax department holds the authority of issuing it. It falls under legal services for NRIs and other natives.

But now, this diaspora is trimmed out of this provision. The foregone Section of Income Tax Act is proposed for amendments. A prescribed condition will be applied for deducting higher rate of TDS. For it, all alternative documents must be fully furnished.

Circumstances under which an NRI can’t file for tax returns:

- If his taxable income includes investment incomes or long term capital gains.

- If the tax has already been deducted at the source of the income.