How to Apply for Police Clearance Certificate in India?

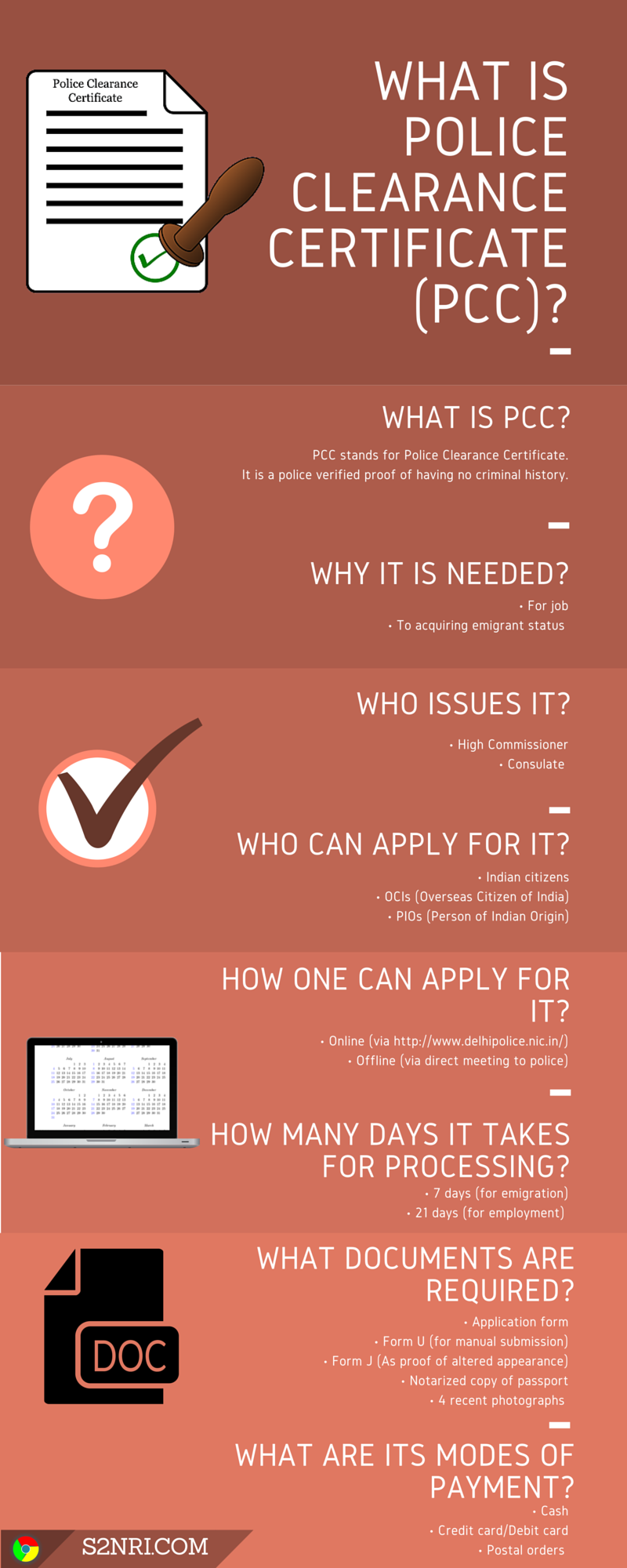

Police Clearance certificate is to check your background if there is any criminal record or lawsuit associated with the applicant of the passport or visa or employment seeker.

Where to Apply

- If you live here in India, obtain it from the Passport Seva Kendra (online) and police station (offline).

- If you are abroad, you will be considered as a non-resident of India. Visit Indian embassy to get it from.

Online Process to Apply Police Clearance Certificate in India

This process is a combination of online and offline application to apply for PCC in India. The applicant, first, fills up the digital copy of the PCC form from the given website and then, schedule an appoint to get it verified offline.

- Get registered with the Passport Seva Online.

- If you’re already registered, log in.

- Select “Apply for Police Clearance Certificate”.

- If you want to get it online, fill up the form online and upload the supporting documents.

If you want to submit this application offline, you can download this form, fill it up and visit the passport office.

- Select the country which you are applying it for like the USA, the UK or France etc..

- Now, move to select the purpose to get it for — Citizenship/ Nationality Application, Education/ Research, Employment Visa/ Work Permit, Immigration Purpose other than Citizenship, Long Term Visa Stay, Residence Permit, Tourist Visa and Others.

- Fill up your details as an applicant-Name, Surname, Gender, Place of Birth, Date of Birth, Citizenship of India by (Birth/ Naturalisation/ Descent), PAN (if have), Voter ID, Employment Type, Marital Status, Educational Qualification and Aadhaar Card.

- Fill up family details –Father Name, Mother Name & Spouse Name (If married).

- Fill up Current Address & select the Regional Passport Office to visit later, if intended to submit offline application. Be careful as you cannot re-select the Regional Passport Office.

- For online applicants, click “Pay & Schedule Appointment” link given on the “View Saved/ Submitted Application”. This step is mandatory to book an offline appointment. Schedule it by paying the requisite fee online.

For payment option, you have credit card, debit card, internet banking from SBI & associated banks or bank challan.

Offline Process

- Upon online application, print through Print Application receipt hyperlink and save Application Reference Number (ARN). This ARN would be used to check the status of the application.

- Upload all self attested supporting documents’ scanned copy.

- Finally, you can visit the passport office on the date of appointment or within 90 days with the supporting documents.

Documents for PCC

- The receipt received from the SMS or text message from the passport office

- Original old passport with the self attested photocopy of the first and last two pages of that passport, including ECR and Non-ECR page

- Current Address Proof, which can be electricity Bill, Water Bill, telephone Bill, Income Tax Assessment Order, Election Commission Photo ID Card (Voter Id), Proof of Gas Connection,

- Certificate of Employment Contract from the Foreign Employer on the letter head,

- Spouse & Parents’ Passport Photocopy,

- Aadhaar Card and Rent Agreement or Photo Passbook of the Current Bank.

Police Verification Validity

The police verification is mandatory if your current residence is other than what is written in your current valid passport.

Suppose you have got your first passport on 1st January 2005 and have applied for the PCC in 2011 from the same old address, you won’t require any police verification. If you have an old passport to be renewed with new address, the police verification will take place once again.

In the nutshell, the police authentication will be necessary only if you have changed your address. There is one more case when you need to undergo this verification again. If your passport is 13 years old, you need to get through the procedure for the Police Clearance Certificate.

How long does it take to get the PCC?

However, this certificate is issued on the very day when you get your passport application verified. But if you need to undergo an offline process for employment, it may take 30 days.

FAQs

What is PCC? Who needs it?

It is a certificate issued to the passport holders in case they have applied for residential status, immigration or long-term visa. It verifies the background of the bearer and clearly states the offence type if there is any record found.

NRIs and also those who are going abroad for employment, study and research need it to show up to the immigration authority of foreign countries.

Do tourists also need this certificate?

No, the one who is going abroad for the purpose of touring doesn’t need it.

What type of applicants can apply for PCC?

- Who are applying for a private job to show his employer

- Who are emigrating from India to another country to comply with Embassy requirements for Visa or an organization for employee recruitment can apply for PCC.

How can you get it?

You can apply for it with the passport application. The form is available on the PSK website to download from.

Besides, every state and place has a website of the police, where you can raise an enquiry to apply for it. This is an online application method, which involves visiting the police website, getting registered, signing in, form filling, uploading supporting documents, online payment and getting receipt.

There is another way that is to visit the nearby police station for getting it physically.

What is the checklist of documents to be enclosed with the PCC application?

- Original old passport with self-attested photocopy of its first two and last two pages including ECR/Non-ECR page and page of observation (if any)

- Proof of Present Address (in case of change of address)

- Self-attested copy of Employment Contract with foreign employer

- Copy of Valid visa (in case visa is already obtained) along with Official English translation if the visa is not in English

- Copy of Valid registration certificate issued by the Protectorate of Emigrants, Ministry of Overseas Indian Affairs, Govt. of India. (for skilled/semi-skilled workers)

- Names of pcensed Recruitment Agents (for skilled/semi-skilled workers)

- Sponsorship declaration by the person who is sponsoring the emigration of the PCC applicant

How much do you pay as a fee for PCC?

You can check the updated fee structure on the official website of the police of your state. In Delhi, it’s like this:

For Debit Card Payment

- Individual Rs.250 + Rs.1.87 (Bank Charges) = Rs.251.87

- Organization Rs. 500/- + Rs.3.75 (Bank Charges) = Rs.503.75

For Credit Card Payment

- Individual needs to pay Rs. 250/- + Rs.2.50 (Bank Charges) = Rs.252.50

- Organization needs to pay Rs. 500/- + Rs. 5.00 (Bank Charges) = Rs. 505.00

How do you know if your application is confirmed online?

You receive an email and a text message on your registered phone number. Check it.

Besides, you receive a receipt at the end with a reference number, which is used for checking the status of the application later.

Where can you apply for it?

You can apply for it from anywhere, either in India or from foreign, over the internet. You should keep into account that it is issued if you are the resident of that place and have a valid ID proof, which should be minimum six months old.

These proofs can be– Election ID Card, Aadhaar Card, Passport, Driving License, Electricity Bill, Telephone Bill, Bank Passbook & Rent Agreement duly registered in the Hon’ble Court of Law/Registrar/SDM Office (Rent Agreement issued by Notary Public is not applicable) in the name of the applicant at present address

Where should an NRI get PCC from if he has been living in abroad for six plus months?

Some of the foreign immigration authorities require a fresh PCC in every six months. If an NRI is living abroad for more than six months, he should get it from the local police in abroad. Also, he should raise a request here in the place where he comes from in India. In short, you should submit two PCCs.

If you have changed the country and spent six or months there, you have to get it from there also. Let’s say, you have been traveling to UAE from the USA and lived for six months. In this case, you have to get the PCC from UAE, India (for being an NRI) and the USA.

How many days does it take to get delivered?

It hardly takes a fortnight or a month if you have applied with the passport application. You should show the voter id or adhaar card or any other proof of two more witnesses at the time of delivery to the verifying officer.

this is link

this is link